LET’S DO THE MATH

The following online home mortgage calculator serves as a helpful tool during the mortgage process. Fill in the form below to see a basic calculation of your mortgage payment. More information and explanation of your calculator results is included below as well.

Home Mortgage Calculator

For Illustrative Purposes Only

The information provided by these pre-approval calculators is for illustrative purposes only and accuracy is not guaranteed. The default figures shown are hypothetical and may not be applicable to your individual situation. Be sure to consult a financial professional prior to relying on the results.

Where Does that Number Come From?

Home Mortgage Payment Calculator Explained

A home mortgage payment can seem like a complex or scary thing to understand. Many wonder, where does that number come from? How is my payment calculated? How does this calculator estimate my monthly payment? What other things do I need to know?

The best way to find the most accurate information about your potential home mortgage is to talk to a home mortgage professional. A professional can give you the most accurate information about your potential for a loan, the amount you qualify for, or how your monthly payments will work.

However, in the meantime, online mortgage payment calculators can give you a great idea of your estimated monthly mortgage payment. Keep in mind these are only estimates and do not take into account all aspects of your mortgage payment or your specific circumstances. For these reasons, calculations from an online calculator should only be viewed as estimates, and not taken as concrete numbers for a loan or financial planning purposes. With this in mind, here is some basic information about how mortgage payments are calculated and how our home mortgage calculator works. For more detailed information or to get a more personalized, accurate quote for your situation, consider a no obligation consultation with a professional such as Security Home Mortgage.

What Are the Different Parts of a Home Mortgage Payment?

Keep in mind that most online home mortgage calculators are using a simple formula to calculate your mortgage payment based on principal and interest. However, a monthly mortgage payment takes in many aspects of financing your home and can be complex and difficult to understand. Your monthly mortgage payment often encompasses more than just paying off your principal loan amount and interes. . For many homeowners, their monthly mortgage payment can also include private mortgage insurance, homeowners insurance, property taxes and other costs. Together, all of these parts of your monthly mortgage payment are called PITI (principal, interest, taxes and insurance). Your entire PITI payment is what

Key Terms to Understand

Before understanding how a home mortgage payment is calculated, make sure that you understand all of the key terms that relate to financing a home. This process can be complex for many people, and you may want to consider consulting with a professional with any additional questions you may have.

Principal: This is the initial loan amount that you are taking out to finance your home.

Down Payment: This is the cash you have up front to go towards the purchase of your home. Generally, the cost of the home less your down payment equals the amount you will need to borrow from a bank, or your mortgage loan principal.

Interest Rate: This is the fee charged by a bank each month in order to borrow their money (through your home loan). Interest is charged as a percent and a higher credit score generally allows you to find better interest rates on your loan. The interest rate is usually given as an annual number, and if you want to calculate your monthly interest rate, you would simply need to divide the annual interest rate by 12.

PMI: Private mortgage insurance (PMI) is generally required if you have a down payment of less that 20 percent on your loan. This amount can vary depending on a lender and most often PMI is simply added to your monthly payment if you require it.

How are Monthly Mortgage Payments Calculated?

With all of the above in mind, let’s explore how a monthly home mortgage payment is calculated. You can estimate this number by hand, if you like using math formulas like these.

M=P [i(1+i)^n] / [(1+i)^n-1]

P = principal or the total loan amount

i = monthly interest rate (or APR/12)

n = number of months required to repay the loan

However, if that is too intimidating for you (math sure can be sometimes!), consider just using an online home mortgage calculator (see above) to get your basic estimates. Below we include a basic explanation of your mortgage calculator results.

Home Mortgage Payment Calculator Explained

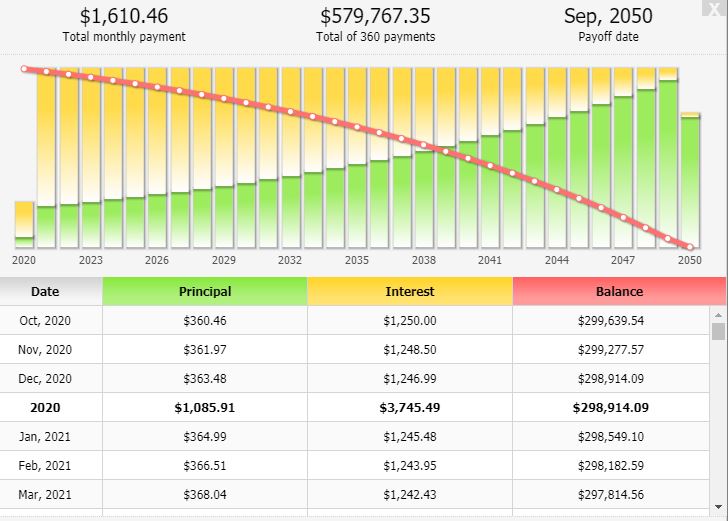

You will notice when you use our online calculator that this screen will appear with a graph showing you how long your mortgage will take to be fully paid, as well as the levels for principal and interest that will likely be paid off in a given year. You can scroll through the table in the calculator to see estimated payments for how much of each category your monthly payment will cover for each month of your mortgage. Listed at the top of the calculator results is your monthly payment each month, the number of payments required for the life of your mortgage, and the total balance you will end up paying as well as the target payoff date.

One important thing to note is that each monthly payment contributes a different amount to the principal versus interest. This is because for each monthly payment, the interest for that month is taken out first, with the remaining amount contributed towards the principal (see table above). This is demonstrated visually through the yellow and green sections on the graph and can also be viewed through an amortization table (below the graph). As the principal is gradually reduced, the interest on that principal decreases and therefore more of your monthly payment is contributed towards the principal. This continues each month until the loan is entirely repaid.

Still have more questions? Please feel free to contact us. We would love to help you understand your mortgage process. Interested in learning more or getting pre-approved? Click the button below!